No real trades this week so far. I tried a couple yesterday prior to inventory that scratched out and one after inventory that scratched out. The bull shitters seem to be out in force this week although to be fair, they always are. Maybe I just notice it more now. I've actually been waiting for this price action the last few days but never found a way to be on board without significant risk. Maybe I don't know how to do that but rather than gamble, I'd rather just wait until the risk is both reasonable and readily observable. Neither of these seemed to be the case so this week. On the other hand, today is setting up to perhaps see a nice long break to the upside tomorrow. If the day closes without making a significant move either way, it will close green setting up a decent long signal on the daily chart. I hope to participate in that tomorrow.

On another note, I need to vent just a bit about a non trading thing. My kiddo is 15, she doesn't drive and she is a freshman in high school this year. She also made the cheer team. This means LOTS of work. Two hours a day practice, junior varsity games on Thursday, varsity games on Friday's, fundraisers every month, one or two Saturdays a month choreography and the list goes on....all this is fine, we signed up for that but what we didn't know was the head coach has an 8-5 job and coaches cheer in the evening. This means we pick our kid up at 2:45PM, go home for 90 minutes and then return to the school at 5:30-7:30 5 nights a week except on Thursdays and Friday's where she will probably get home around 10:00 after the games. She is expected to maintain good grades, be involved in other school activities plus whatever family obligations we might have.

The issue is the practice start time. The school just gave the finger to dozens of parents because the coach is a lawyer that won't change her schedule to better accommodate all these parents, many of whom have at least one job and sometimes two. I spoke to the coach and the athletic director and they both essentially gave me the finger. There was no communication about how difficult the schedule was going to be BEFORE we signed the contract to make it to all the practices, games and other events. We knew there would be lots of work but we honestly felt like we got rear ended and then to just be blown off like we were today made me realize how other parents we have know over the years who have been upset with their kid's school feel. I've always blamed the parents for being poor sports or just being assholes about it but now I understand. Its as though the school doesn't give a damn about the parents. They just want the kids on the property for as long as possible. I'm about read to have a coronary over this....and its really not that big a deal. I am more pissed over the attitude than I am over the actual issue. A for profit company would never get away with something like this. There would be blood in street.

All that said, we are leaving the decision to stay or leave the team up to our daughter. It's time for her to begin making bigger decisions that affect her future. We will walk with her through it and guide her through the pros and cons but its gonna end up being her decision. If she decides to stick with it, then there will be a ton of work to maintain grades which come first. We will do all we can to enable her to balance the load and if she decides to focus on school work and quit the team, we will do all we can to ensure her decision isn't regretted later. High school is supposed to be fun and we want to make sure she has her fair share during these next four years. Grades are important for the future (kinda) whereas cheer is not a marketable skill except in the narrowest of situations.

Back to trading.

I have a long trade on right now with minimum size. I am not convinced yet and so I am waiting for a bit more price action in my favor before adding size. So far its just sitting there going on ten minutes. It is showing some signs of heading up but still to soon to know....with the narrow ranges, the targets are fairly small, not sure if the reward is worth the risk in all honesty. This will be my second trade of the day. Both longs. I bought 46.49 early on and only took about 10-15 ticks. Of course its gone much further than that but at the time, that is what I saw as resistance to further upside. But if the day is long and it appears that it will finish that way, then the right choice would have been to hold all day. I didn't have that kind of time so I took what appeared to be the right target. I'm doing the same right now. Smallish target inside yesterday's 50% level. If it gets there that is. I think it will, that would be about the right level for a break out tomorrow.

Keep Calm and Don't Move Your Stops.....

A little risk management saves a lot of fan cleaning!

The Purpose of Life is Joy!!

Thursday, August 17, 2017

Sunday, August 13, 2017

weekly update

This was an interesting week from a variety of standpoints. I finished up 4% after friday's trading, no charts as I didn't take any pics. However I learned a few things about myself and my trading which I noted in the blog and won't repeat here and a ton of other stuff happened as well.

My wife had a minor wrist surgery on Thursday.

I had an eye doc appointment on Friday morning.

My daughter made the high school cheer squad as a freshman (but I think everyone that tied out made it as well so not sure if this is a big deal or not) Still, she's both nervous and excited.

I had a fairly major angina attack. It hurt like heck and lasted for about 3 hours and I didn't have any nitro with me. Not fun at all.

My total weight loss for the 30 days I've been doing intermittent fasting as of this morning is 13.2 pounds. Last week I had 2 cheat days where I had a small coke and yesterday I had two pieces of pizza with maybe three swallows of coke to wash it down. I still lost a total of 2 pounds last week bringing my 30 day total to 13.2

I'm not keto yet. I never tried actually although I think I will at some point, but I have gotten rid of 99.9% of the sugar or at least extra sugar, 99.9% of the bread, rice, pasta, potatoes, etc along with reducing my portion size to probably half of what I used to eat.

I feel TONS better already, the brain fog is gone, my low blood sugar issue is no longer an issue, I can fast for 16-17 hours without unpleasant side affects ( not true the first 3-4 days) I have more energy that is sustained throughout the day. Frankly I am stunned at how well this has worked with almost no effort on my part. And to top it all off, last week I actually had the desire to work out. I have intellectually made the decision to work out in the past but I never wanted to but this week I wanted to and so I did. Of course I regretted it almost instantly as it was not easy but just like anything else, it will get easier as time goes by. I have no intention of becoming Mr Olympia, I just want to be healthy and fit again.

This feels sustainable unlike anything else I've ever done and that is what I was ultimately looking for, easy sustainability.

On a different note, I am looking for a new laptop. I want a 13 inch ultra book with a very small footprint and very lightweight and I'm having a terrible time deciding between machines. Anyone with any experience that would share with me? Just email me your ideas or suggestions. use the form at the side of the blog. It will go straight to me.

Ok, time to move on to other things this morning. Cheers.

My wife had a minor wrist surgery on Thursday.

I had an eye doc appointment on Friday morning.

My daughter made the high school cheer squad as a freshman (but I think everyone that tied out made it as well so not sure if this is a big deal or not) Still, she's both nervous and excited.

I had a fairly major angina attack. It hurt like heck and lasted for about 3 hours and I didn't have any nitro with me. Not fun at all.

My total weight loss for the 30 days I've been doing intermittent fasting as of this morning is 13.2 pounds. Last week I had 2 cheat days where I had a small coke and yesterday I had two pieces of pizza with maybe three swallows of coke to wash it down. I still lost a total of 2 pounds last week bringing my 30 day total to 13.2

I'm not keto yet. I never tried actually although I think I will at some point, but I have gotten rid of 99.9% of the sugar or at least extra sugar, 99.9% of the bread, rice, pasta, potatoes, etc along with reducing my portion size to probably half of what I used to eat.

I feel TONS better already, the brain fog is gone, my low blood sugar issue is no longer an issue, I can fast for 16-17 hours without unpleasant side affects ( not true the first 3-4 days) I have more energy that is sustained throughout the day. Frankly I am stunned at how well this has worked with almost no effort on my part. And to top it all off, last week I actually had the desire to work out. I have intellectually made the decision to work out in the past but I never wanted to but this week I wanted to and so I did. Of course I regretted it almost instantly as it was not easy but just like anything else, it will get easier as time goes by. I have no intention of becoming Mr Olympia, I just want to be healthy and fit again.

This feels sustainable unlike anything else I've ever done and that is what I was ultimately looking for, easy sustainability.

On a different note, I am looking for a new laptop. I want a 13 inch ultra book with a very small footprint and very lightweight and I'm having a terrible time deciding between machines. Anyone with any experience that would share with me? Just email me your ideas or suggestions. use the form at the side of the blog. It will go straight to me.

Ok, time to move on to other things this morning. Cheers.

Thursday, August 10, 2017

-1%

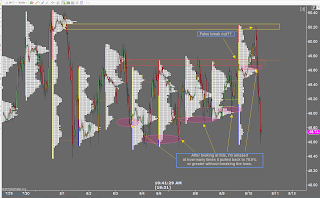

Today was interesting to say the least. I didn't do much. I shorted the near the very top and unlike yesterday when I was confident in the short, today I had some fairly serious doubts about the validity of the short. Turns out that was completely wrong headed. Instead, I chose the obvious place to be long (with a bit of confirmation) and got run over for a full 1% stop out and done for the day.

As you can see from the pics I figured out it was short AFTER I got ran over only because I didn't do the work ahead of time to fully appreciate the strength of the resistance. Had I done that, I would have had more confidence in the short and added to it as time went by instead of placing my take profit order so darn close. In the end though, it just goes to show you have to do the work if you plan on making money.

On a side note, I left the house immediately after getting run over. My wife had a minor wrist surgery today to remove a cyst that came back after having the same procedure done a year ago. Doc said it would not come back a third time. So I am entertaining my wife for the next 7 days as she recovers. She's left handed and the surgery was on the left hand so this means I'm also the cook/cleaner/driver/etc as well. Should be fun!!

Cheers.

As you can see from the pics I figured out it was short AFTER I got ran over only because I didn't do the work ahead of time to fully appreciate the strength of the resistance. Had I done that, I would have had more confidence in the short and added to it as time went by instead of placing my take profit order so darn close. In the end though, it just goes to show you have to do the work if you plan on making money.

On a side note, I left the house immediately after getting run over. My wife had a minor wrist surgery today to remove a cyst that came back after having the same procedure done a year ago. Doc said it would not come back a third time. So I am entertaining my wife for the next 7 days as she recovers. She's left handed and the surgery was on the left hand so this means I'm also the cook/cleaner/driver/etc as well. Should be fun!!

Cheers.

Wednesday, August 9, 2017

+1% and an emotional shit storm

Today is one of the most enlightening and interesting days I've ever had as a trader. Lets start by saying that I had a very nice counter trend trade today that I played very intelligently, very calmly executed almost to perfection. It was a nice winner as well. So why the emotional shit storm you ask?

Its like this. Looking at the charts, I had my entry levels off the profile, I scaled into the trade at each level with my overall risk mostly in line. To be fair, through the early part of the trade, there was slightly to much risk in terms of ticks but not excessively. I was comfortable with it because as it moved against me, the pace of the tape was quite slow with no aggressive buying at all. At no time did my dollar risk ever get past 1%.

As the tape moved in my favor, I knew my profit targets were realistic and probable. The only question was how long. I sat in this trade for about 2 1/2 hours. Something I have NEVER done before. Did I mention I hate counter trend trades? They take way to long in my opinion. However once the risk was out of the trade, I just forgot about it and let it play out into inventory. Just before inventory, I moved my stop to break even just in case it went against me with some violence. No need to take the stop plus any slippage. However, the trade was good and the inventory number filled my first two targets instantly. The runner wasn't really a runner, it was just a stretch number that I thought might get hit as well with the number. But no, it stopped a few ticks short, went back up and I exited the last position at BE+5 I think. I did move 2/3rds of the position up to aproximately the 50% level prior to inventory but this is not noted on the charts.

At that point, I was up over 1% having just executed a near perfect trade and yet I was left with a huge empty spot in my soul where normally I would have been fist pumping at having just scored a great win. The issue was this. The trade did not play out EXACTLY the way I thought it should and left me with less than I could have had with a full exit at the first target. To make matters worse, as I was marking my charts, price reversed and plunged right back down to where my stretch target had been. I think the whole thing took 3 minutes. So now instead of just being emotionally unsatisfied, I was just pissed about the whole thing. Seriously, I just made 1% and I'm upset? This should not be and yet I recognize this emotional dissatisfaction with a perfect trade is a very real aspect of trading. There is always a disconnect between taking what is offered at the moment and not seeing the future rewards or losses if you follow a different path.

I suppose this is something all successful traders experience. The thrill of winning but not winning big enough based on what happened after the trade is closed. Leaving money on the table. In sports, you win or lose. If you win, even by one run or one point, you celebrate the win. If you lose, even by one point, you still lost. Shake it off and play again tomorrow. In trading, if you win, it could have been MUCH bigger or if you lose, you could have cut the losses much sooner. It's a no win situation and if one is to be a long term success in this business, one must come to terms with this feeling and enjoy the satisfaction of following a well thought out process even if it doesn't work or if it yields much more than you actually achieved. The joy is in the process. The score is not the score. The score is just the result of the process. The process is the win.

Ok, here are the charts from beginning to end. Well there aren't any where the trade is firmly in profit because I was taking my daughter to school during that time.

Tuesday, August 8, 2017

+2%

Execution was ass backwards but the result was exactly (more or less) what I wanted. The more was that price did exactly what I thought it might do, the less was I scaled out of the position a bit early. It ended up a 2% day but could woulda shoulda been a 3.7% day.

A huge difference maker for me today was the stop, Instead of trying to keep it tight, I sized way down, opened the stop way up, and scaled into the trade as price moved against me. The correct way would have been to wait for the second entry to be the first, the third to have been the second and the first to have been the third and last entry and then held the whole thing to T3. Instead I went in backward and scaled out to soon. Still I am happy with the overall result.

Single chart today....take a look at your 5M chart for the exact particulars.

A huge difference maker for me today was the stop, Instead of trying to keep it tight, I sized way down, opened the stop way up, and scaled into the trade as price moved against me. The correct way would have been to wait for the second entry to be the first, the third to have been the second and the first to have been the third and last entry and then held the whole thing to T3. Instead I went in backward and scaled out to soon. Still I am happy with the overall result.

Single chart today....take a look at your 5M chart for the exact particulars.

Monday, August 7, 2017

+1%

Last week was mostly a scratch week. I fell into the trap of trying to manufacture trades again. I realized my trade selection criteria is not very robust so on the advice of a friend, I implemented a higher time frame analysis using weekly and daily profile charts. I further implemented some rules about risk management having to do with trade count, daily, weekly and monthly draw down limits as well as the per trade risk.

This led to a more robust trade selection process this morning, or at least a more robust initial trade selection. Those details later.

My overall premise was sound, my execution was lacking because I ran out of patience with the initial sequence and I foolishly reversed my position because during the selection process, I made a case for both longs and shorts. The longs were not working as fast as I thought they should and so reversed into a short position only to realize the mistake shortly thereafter and reversed again, taking losses on both reverses.

However, keeping the risk in line with the above mentioned parameters allowed me to take the losers and add very quickly to the winner and overcome those losses and end up with a 1% win for the day. Oddly enough, the short case I laid out also worked well but I was long gone by that time. I had an early morning meeting and had to go.

A big thumbs up for the profit, a big thumbs down for the execution. Sometimes it works out like that. The goal is to minimize the size of the inevitable mistakes and maximize the size of the winners when you get it right. I may have gotten the selection process all screwed up as well. Maybe I should have been waiting on the short that happened after I was done. Small risk there with bigger reward....who knows. I made money following a step by step process and that is what counts.

This led to a more robust trade selection process this morning, or at least a more robust initial trade selection. Those details later.

My overall premise was sound, my execution was lacking because I ran out of patience with the initial sequence and I foolishly reversed my position because during the selection process, I made a case for both longs and shorts. The longs were not working as fast as I thought they should and so reversed into a short position only to realize the mistake shortly thereafter and reversed again, taking losses on both reverses.

However, keeping the risk in line with the above mentioned parameters allowed me to take the losers and add very quickly to the winner and overcome those losses and end up with a 1% win for the day. Oddly enough, the short case I laid out also worked well but I was long gone by that time. I had an early morning meeting and had to go.

A big thumbs up for the profit, a big thumbs down for the execution. Sometimes it works out like that. The goal is to minimize the size of the inevitable mistakes and maximize the size of the winners when you get it right. I may have gotten the selection process all screwed up as well. Maybe I should have been waiting on the short that happened after I was done. Small risk there with bigger reward....who knows. I made money following a step by step process and that is what counts.

Subscribe to:

Posts (Atom)