Keep Calm and Don't Move Your Stops.....

A little risk management saves a lot of fan cleaning!

The Purpose of Life is Joy!!

Wednesday, November 29, 2017

Monday, October 30, 2017

Posterity

This has parallels in trading but is true across all areas of life.

As I was thinking about things this morning, it occurred to me that joy comes not from the fruit of the labor but from the labor itself.

There is pleasure in the thinking, the planning, the strategy implementation and finally realizing the outcome, good or bad. Truthfully, well thought out, well planned and properly implemented plans that fail are just as good at producing pleasure as ones that do not for we cannot know the outcome in advance and therefore carry equal amounts of pleasure and uncertainty.

The fruit of labor is nothing more than the result of planning and implementation carried to its natural conclusion. A man can enjoy that fruit with extreme satisfaction knowing the effort, thought and planning that went into producing that fruit.

I'm not certain where this thought came from but I suspect it came from the moments of quiet and meditation I have been enjoying in the mornings these last few weeks. I know its not earth shattering or particularly deep but for me it was insightful and motivating as my goal has always been the fruit and not the pleasure of the labor. From now on I will pursue the pleasure of the labor and let the fruit develop on its own.

As I was thinking about things this morning, it occurred to me that joy comes not from the fruit of the labor but from the labor itself.

There is pleasure in the thinking, the planning, the strategy implementation and finally realizing the outcome, good or bad. Truthfully, well thought out, well planned and properly implemented plans that fail are just as good at producing pleasure as ones that do not for we cannot know the outcome in advance and therefore carry equal amounts of pleasure and uncertainty.

The fruit of labor is nothing more than the result of planning and implementation carried to its natural conclusion. A man can enjoy that fruit with extreme satisfaction knowing the effort, thought and planning that went into producing that fruit.

I'm not certain where this thought came from but I suspect it came from the moments of quiet and meditation I have been enjoying in the mornings these last few weeks. I know its not earth shattering or particularly deep but for me it was insightful and motivating as my goal has always been the fruit and not the pleasure of the labor. From now on I will pursue the pleasure of the labor and let the fruit develop on its own.

Sunday, September 17, 2017

Extended Hiatus

I've been gone for awhile and I will be gone for an undetermined amount of time. I've been doing consulting work over the summer and that is finally over at least for now. However, since last September, a major bank has been after me to work for them. I put them off for a long time until after my father passed and then I didn't feel like working after that. Then the consulting thing came along and I did that for a while but the bank came calling again a couple of months ago with a better offer.

I took them up on that offer and I finished my training last week in Chicago. I am a full on employee again. I will be working 40+ hours a week in the mortgage business and truthfully I am fairly excited about it. I am good at it and I know I can make mid low six figures a year. Plus there are great benefits which my family needs.

However, I do not intend to abandon trading altogether. While I am probably done as a day trader, I am looking forward to switching to forex as a long term swing trader using daily, weekly and monthly charts and holding for weeks and potentially months.

Day trading simply has not produced the sustainable gains that I had hoped. I am not sure I have the temperament for it. I like instant satisfaction when I am sitting in front of the machine. With longer term trading, I feel like a set and forget strategy will be more suited for me. I'm not 100% certain about that but I have had success in the past with it and so hopefully it will repeat itself. At some point, I may come back to day trading but it will be under completely different circumstances and with much better funding than I have today. But in all honesty, I think I will give myself probably a year off before I think about coming back to day trading.

I'll still follow a couple of traders whose work I feel is important but for the most part I plan on withdrawing from day trading inputs. I need to give most of my attention to my new employer at least for the near future while I build a business to where it is self sustaining which I think will take a year.

Once I start trading forex with any degree of size, I will start posting here again. Until then, it has been fun, exciting, disappointing, frustrating, etc. I've run the emotional gamut in this trading game and yet I do not regret even one second of it. This journey has helped me grow in ways I did not know I needed to grow.

Cheers and good luck to all.

I took them up on that offer and I finished my training last week in Chicago. I am a full on employee again. I will be working 40+ hours a week in the mortgage business and truthfully I am fairly excited about it. I am good at it and I know I can make mid low six figures a year. Plus there are great benefits which my family needs.

However, I do not intend to abandon trading altogether. While I am probably done as a day trader, I am looking forward to switching to forex as a long term swing trader using daily, weekly and monthly charts and holding for weeks and potentially months.

Day trading simply has not produced the sustainable gains that I had hoped. I am not sure I have the temperament for it. I like instant satisfaction when I am sitting in front of the machine. With longer term trading, I feel like a set and forget strategy will be more suited for me. I'm not 100% certain about that but I have had success in the past with it and so hopefully it will repeat itself. At some point, I may come back to day trading but it will be under completely different circumstances and with much better funding than I have today. But in all honesty, I think I will give myself probably a year off before I think about coming back to day trading.

I'll still follow a couple of traders whose work I feel is important but for the most part I plan on withdrawing from day trading inputs. I need to give most of my attention to my new employer at least for the near future while I build a business to where it is self sustaining which I think will take a year.

Once I start trading forex with any degree of size, I will start posting here again. Until then, it has been fun, exciting, disappointing, frustrating, etc. I've run the emotional gamut in this trading game and yet I do not regret even one second of it. This journey has helped me grow in ways I did not know I needed to grow.

Cheers and good luck to all.

Thursday, August 17, 2017

No Bull Shit Zone

No real trades this week so far. I tried a couple yesterday prior to inventory that scratched out and one after inventory that scratched out. The bull shitters seem to be out in force this week although to be fair, they always are. Maybe I just notice it more now. I've actually been waiting for this price action the last few days but never found a way to be on board without significant risk. Maybe I don't know how to do that but rather than gamble, I'd rather just wait until the risk is both reasonable and readily observable. Neither of these seemed to be the case so this week. On the other hand, today is setting up to perhaps see a nice long break to the upside tomorrow. If the day closes without making a significant move either way, it will close green setting up a decent long signal on the daily chart. I hope to participate in that tomorrow.

On another note, I need to vent just a bit about a non trading thing. My kiddo is 15, she doesn't drive and she is a freshman in high school this year. She also made the cheer team. This means LOTS of work. Two hours a day practice, junior varsity games on Thursday, varsity games on Friday's, fundraisers every month, one or two Saturdays a month choreography and the list goes on....all this is fine, we signed up for that but what we didn't know was the head coach has an 8-5 job and coaches cheer in the evening. This means we pick our kid up at 2:45PM, go home for 90 minutes and then return to the school at 5:30-7:30 5 nights a week except on Thursdays and Friday's where she will probably get home around 10:00 after the games. She is expected to maintain good grades, be involved in other school activities plus whatever family obligations we might have.

The issue is the practice start time. The school just gave the finger to dozens of parents because the coach is a lawyer that won't change her schedule to better accommodate all these parents, many of whom have at least one job and sometimes two. I spoke to the coach and the athletic director and they both essentially gave me the finger. There was no communication about how difficult the schedule was going to be BEFORE we signed the contract to make it to all the practices, games and other events. We knew there would be lots of work but we honestly felt like we got rear ended and then to just be blown off like we were today made me realize how other parents we have know over the years who have been upset with their kid's school feel. I've always blamed the parents for being poor sports or just being assholes about it but now I understand. Its as though the school doesn't give a damn about the parents. They just want the kids on the property for as long as possible. I'm about read to have a coronary over this....and its really not that big a deal. I am more pissed over the attitude than I am over the actual issue. A for profit company would never get away with something like this. There would be blood in street.

All that said, we are leaving the decision to stay or leave the team up to our daughter. It's time for her to begin making bigger decisions that affect her future. We will walk with her through it and guide her through the pros and cons but its gonna end up being her decision. If she decides to stick with it, then there will be a ton of work to maintain grades which come first. We will do all we can to enable her to balance the load and if she decides to focus on school work and quit the team, we will do all we can to ensure her decision isn't regretted later. High school is supposed to be fun and we want to make sure she has her fair share during these next four years. Grades are important for the future (kinda) whereas cheer is not a marketable skill except in the narrowest of situations.

Back to trading.

I have a long trade on right now with minimum size. I am not convinced yet and so I am waiting for a bit more price action in my favor before adding size. So far its just sitting there going on ten minutes. It is showing some signs of heading up but still to soon to know....with the narrow ranges, the targets are fairly small, not sure if the reward is worth the risk in all honesty. This will be my second trade of the day. Both longs. I bought 46.49 early on and only took about 10-15 ticks. Of course its gone much further than that but at the time, that is what I saw as resistance to further upside. But if the day is long and it appears that it will finish that way, then the right choice would have been to hold all day. I didn't have that kind of time so I took what appeared to be the right target. I'm doing the same right now. Smallish target inside yesterday's 50% level. If it gets there that is. I think it will, that would be about the right level for a break out tomorrow.

On another note, I need to vent just a bit about a non trading thing. My kiddo is 15, she doesn't drive and she is a freshman in high school this year. She also made the cheer team. This means LOTS of work. Two hours a day practice, junior varsity games on Thursday, varsity games on Friday's, fundraisers every month, one or two Saturdays a month choreography and the list goes on....all this is fine, we signed up for that but what we didn't know was the head coach has an 8-5 job and coaches cheer in the evening. This means we pick our kid up at 2:45PM, go home for 90 minutes and then return to the school at 5:30-7:30 5 nights a week except on Thursdays and Friday's where she will probably get home around 10:00 after the games. She is expected to maintain good grades, be involved in other school activities plus whatever family obligations we might have.

The issue is the practice start time. The school just gave the finger to dozens of parents because the coach is a lawyer that won't change her schedule to better accommodate all these parents, many of whom have at least one job and sometimes two. I spoke to the coach and the athletic director and they both essentially gave me the finger. There was no communication about how difficult the schedule was going to be BEFORE we signed the contract to make it to all the practices, games and other events. We knew there would be lots of work but we honestly felt like we got rear ended and then to just be blown off like we were today made me realize how other parents we have know over the years who have been upset with their kid's school feel. I've always blamed the parents for being poor sports or just being assholes about it but now I understand. Its as though the school doesn't give a damn about the parents. They just want the kids on the property for as long as possible. I'm about read to have a coronary over this....and its really not that big a deal. I am more pissed over the attitude than I am over the actual issue. A for profit company would never get away with something like this. There would be blood in street.

All that said, we are leaving the decision to stay or leave the team up to our daughter. It's time for her to begin making bigger decisions that affect her future. We will walk with her through it and guide her through the pros and cons but its gonna end up being her decision. If she decides to stick with it, then there will be a ton of work to maintain grades which come first. We will do all we can to enable her to balance the load and if she decides to focus on school work and quit the team, we will do all we can to ensure her decision isn't regretted later. High school is supposed to be fun and we want to make sure she has her fair share during these next four years. Grades are important for the future (kinda) whereas cheer is not a marketable skill except in the narrowest of situations.

Back to trading.

I have a long trade on right now with minimum size. I am not convinced yet and so I am waiting for a bit more price action in my favor before adding size. So far its just sitting there going on ten minutes. It is showing some signs of heading up but still to soon to know....with the narrow ranges, the targets are fairly small, not sure if the reward is worth the risk in all honesty. This will be my second trade of the day. Both longs. I bought 46.49 early on and only took about 10-15 ticks. Of course its gone much further than that but at the time, that is what I saw as resistance to further upside. But if the day is long and it appears that it will finish that way, then the right choice would have been to hold all day. I didn't have that kind of time so I took what appeared to be the right target. I'm doing the same right now. Smallish target inside yesterday's 50% level. If it gets there that is. I think it will, that would be about the right level for a break out tomorrow.

Sunday, August 13, 2017

weekly update

This was an interesting week from a variety of standpoints. I finished up 4% after friday's trading, no charts as I didn't take any pics. However I learned a few things about myself and my trading which I noted in the blog and won't repeat here and a ton of other stuff happened as well.

My wife had a minor wrist surgery on Thursday.

I had an eye doc appointment on Friday morning.

My daughter made the high school cheer squad as a freshman (but I think everyone that tied out made it as well so not sure if this is a big deal or not) Still, she's both nervous and excited.

I had a fairly major angina attack. It hurt like heck and lasted for about 3 hours and I didn't have any nitro with me. Not fun at all.

My total weight loss for the 30 days I've been doing intermittent fasting as of this morning is 13.2 pounds. Last week I had 2 cheat days where I had a small coke and yesterday I had two pieces of pizza with maybe three swallows of coke to wash it down. I still lost a total of 2 pounds last week bringing my 30 day total to 13.2

I'm not keto yet. I never tried actually although I think I will at some point, but I have gotten rid of 99.9% of the sugar or at least extra sugar, 99.9% of the bread, rice, pasta, potatoes, etc along with reducing my portion size to probably half of what I used to eat.

I feel TONS better already, the brain fog is gone, my low blood sugar issue is no longer an issue, I can fast for 16-17 hours without unpleasant side affects ( not true the first 3-4 days) I have more energy that is sustained throughout the day. Frankly I am stunned at how well this has worked with almost no effort on my part. And to top it all off, last week I actually had the desire to work out. I have intellectually made the decision to work out in the past but I never wanted to but this week I wanted to and so I did. Of course I regretted it almost instantly as it was not easy but just like anything else, it will get easier as time goes by. I have no intention of becoming Mr Olympia, I just want to be healthy and fit again.

This feels sustainable unlike anything else I've ever done and that is what I was ultimately looking for, easy sustainability.

On a different note, I am looking for a new laptop. I want a 13 inch ultra book with a very small footprint and very lightweight and I'm having a terrible time deciding between machines. Anyone with any experience that would share with me? Just email me your ideas or suggestions. use the form at the side of the blog. It will go straight to me.

Ok, time to move on to other things this morning. Cheers.

My wife had a minor wrist surgery on Thursday.

I had an eye doc appointment on Friday morning.

My daughter made the high school cheer squad as a freshman (but I think everyone that tied out made it as well so not sure if this is a big deal or not) Still, she's both nervous and excited.

I had a fairly major angina attack. It hurt like heck and lasted for about 3 hours and I didn't have any nitro with me. Not fun at all.

My total weight loss for the 30 days I've been doing intermittent fasting as of this morning is 13.2 pounds. Last week I had 2 cheat days where I had a small coke and yesterday I had two pieces of pizza with maybe three swallows of coke to wash it down. I still lost a total of 2 pounds last week bringing my 30 day total to 13.2

I'm not keto yet. I never tried actually although I think I will at some point, but I have gotten rid of 99.9% of the sugar or at least extra sugar, 99.9% of the bread, rice, pasta, potatoes, etc along with reducing my portion size to probably half of what I used to eat.

I feel TONS better already, the brain fog is gone, my low blood sugar issue is no longer an issue, I can fast for 16-17 hours without unpleasant side affects ( not true the first 3-4 days) I have more energy that is sustained throughout the day. Frankly I am stunned at how well this has worked with almost no effort on my part. And to top it all off, last week I actually had the desire to work out. I have intellectually made the decision to work out in the past but I never wanted to but this week I wanted to and so I did. Of course I regretted it almost instantly as it was not easy but just like anything else, it will get easier as time goes by. I have no intention of becoming Mr Olympia, I just want to be healthy and fit again.

This feels sustainable unlike anything else I've ever done and that is what I was ultimately looking for, easy sustainability.

On a different note, I am looking for a new laptop. I want a 13 inch ultra book with a very small footprint and very lightweight and I'm having a terrible time deciding between machines. Anyone with any experience that would share with me? Just email me your ideas or suggestions. use the form at the side of the blog. It will go straight to me.

Ok, time to move on to other things this morning. Cheers.

Thursday, August 10, 2017

-1%

Today was interesting to say the least. I didn't do much. I shorted the near the very top and unlike yesterday when I was confident in the short, today I had some fairly serious doubts about the validity of the short. Turns out that was completely wrong headed. Instead, I chose the obvious place to be long (with a bit of confirmation) and got run over for a full 1% stop out and done for the day.

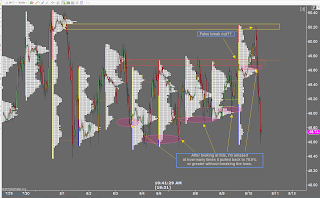

As you can see from the pics I figured out it was short AFTER I got ran over only because I didn't do the work ahead of time to fully appreciate the strength of the resistance. Had I done that, I would have had more confidence in the short and added to it as time went by instead of placing my take profit order so darn close. In the end though, it just goes to show you have to do the work if you plan on making money.

On a side note, I left the house immediately after getting run over. My wife had a minor wrist surgery today to remove a cyst that came back after having the same procedure done a year ago. Doc said it would not come back a third time. So I am entertaining my wife for the next 7 days as she recovers. She's left handed and the surgery was on the left hand so this means I'm also the cook/cleaner/driver/etc as well. Should be fun!!

Cheers.

As you can see from the pics I figured out it was short AFTER I got ran over only because I didn't do the work ahead of time to fully appreciate the strength of the resistance. Had I done that, I would have had more confidence in the short and added to it as time went by instead of placing my take profit order so darn close. In the end though, it just goes to show you have to do the work if you plan on making money.

On a side note, I left the house immediately after getting run over. My wife had a minor wrist surgery today to remove a cyst that came back after having the same procedure done a year ago. Doc said it would not come back a third time. So I am entertaining my wife for the next 7 days as she recovers. She's left handed and the surgery was on the left hand so this means I'm also the cook/cleaner/driver/etc as well. Should be fun!!

Cheers.

Wednesday, August 9, 2017

+1% and an emotional shit storm

Today is one of the most enlightening and interesting days I've ever had as a trader. Lets start by saying that I had a very nice counter trend trade today that I played very intelligently, very calmly executed almost to perfection. It was a nice winner as well. So why the emotional shit storm you ask?

Its like this. Looking at the charts, I had my entry levels off the profile, I scaled into the trade at each level with my overall risk mostly in line. To be fair, through the early part of the trade, there was slightly to much risk in terms of ticks but not excessively. I was comfortable with it because as it moved against me, the pace of the tape was quite slow with no aggressive buying at all. At no time did my dollar risk ever get past 1%.

As the tape moved in my favor, I knew my profit targets were realistic and probable. The only question was how long. I sat in this trade for about 2 1/2 hours. Something I have NEVER done before. Did I mention I hate counter trend trades? They take way to long in my opinion. However once the risk was out of the trade, I just forgot about it and let it play out into inventory. Just before inventory, I moved my stop to break even just in case it went against me with some violence. No need to take the stop plus any slippage. However, the trade was good and the inventory number filled my first two targets instantly. The runner wasn't really a runner, it was just a stretch number that I thought might get hit as well with the number. But no, it stopped a few ticks short, went back up and I exited the last position at BE+5 I think. I did move 2/3rds of the position up to aproximately the 50% level prior to inventory but this is not noted on the charts.

At that point, I was up over 1% having just executed a near perfect trade and yet I was left with a huge empty spot in my soul where normally I would have been fist pumping at having just scored a great win. The issue was this. The trade did not play out EXACTLY the way I thought it should and left me with less than I could have had with a full exit at the first target. To make matters worse, as I was marking my charts, price reversed and plunged right back down to where my stretch target had been. I think the whole thing took 3 minutes. So now instead of just being emotionally unsatisfied, I was just pissed about the whole thing. Seriously, I just made 1% and I'm upset? This should not be and yet I recognize this emotional dissatisfaction with a perfect trade is a very real aspect of trading. There is always a disconnect between taking what is offered at the moment and not seeing the future rewards or losses if you follow a different path.

I suppose this is something all successful traders experience. The thrill of winning but not winning big enough based on what happened after the trade is closed. Leaving money on the table. In sports, you win or lose. If you win, even by one run or one point, you celebrate the win. If you lose, even by one point, you still lost. Shake it off and play again tomorrow. In trading, if you win, it could have been MUCH bigger or if you lose, you could have cut the losses much sooner. It's a no win situation and if one is to be a long term success in this business, one must come to terms with this feeling and enjoy the satisfaction of following a well thought out process even if it doesn't work or if it yields much more than you actually achieved. The joy is in the process. The score is not the score. The score is just the result of the process. The process is the win.

Ok, here are the charts from beginning to end. Well there aren't any where the trade is firmly in profit because I was taking my daughter to school during that time.

Tuesday, August 8, 2017

+2%

Execution was ass backwards but the result was exactly (more or less) what I wanted. The more was that price did exactly what I thought it might do, the less was I scaled out of the position a bit early. It ended up a 2% day but could woulda shoulda been a 3.7% day.

A huge difference maker for me today was the stop, Instead of trying to keep it tight, I sized way down, opened the stop way up, and scaled into the trade as price moved against me. The correct way would have been to wait for the second entry to be the first, the third to have been the second and the first to have been the third and last entry and then held the whole thing to T3. Instead I went in backward and scaled out to soon. Still I am happy with the overall result.

Single chart today....take a look at your 5M chart for the exact particulars.

A huge difference maker for me today was the stop, Instead of trying to keep it tight, I sized way down, opened the stop way up, and scaled into the trade as price moved against me. The correct way would have been to wait for the second entry to be the first, the third to have been the second and the first to have been the third and last entry and then held the whole thing to T3. Instead I went in backward and scaled out to soon. Still I am happy with the overall result.

Single chart today....take a look at your 5M chart for the exact particulars.

Monday, August 7, 2017

+1%

Last week was mostly a scratch week. I fell into the trap of trying to manufacture trades again. I realized my trade selection criteria is not very robust so on the advice of a friend, I implemented a higher time frame analysis using weekly and daily profile charts. I further implemented some rules about risk management having to do with trade count, daily, weekly and monthly draw down limits as well as the per trade risk.

This led to a more robust trade selection process this morning, or at least a more robust initial trade selection. Those details later.

My overall premise was sound, my execution was lacking because I ran out of patience with the initial sequence and I foolishly reversed my position because during the selection process, I made a case for both longs and shorts. The longs were not working as fast as I thought they should and so reversed into a short position only to realize the mistake shortly thereafter and reversed again, taking losses on both reverses.

However, keeping the risk in line with the above mentioned parameters allowed me to take the losers and add very quickly to the winner and overcome those losses and end up with a 1% win for the day. Oddly enough, the short case I laid out also worked well but I was long gone by that time. I had an early morning meeting and had to go.

A big thumbs up for the profit, a big thumbs down for the execution. Sometimes it works out like that. The goal is to minimize the size of the inevitable mistakes and maximize the size of the winners when you get it right. I may have gotten the selection process all screwed up as well. Maybe I should have been waiting on the short that happened after I was done. Small risk there with bigger reward....who knows. I made money following a step by step process and that is what counts.

This led to a more robust trade selection process this morning, or at least a more robust initial trade selection. Those details later.

My overall premise was sound, my execution was lacking because I ran out of patience with the initial sequence and I foolishly reversed my position because during the selection process, I made a case for both longs and shorts. The longs were not working as fast as I thought they should and so reversed into a short position only to realize the mistake shortly thereafter and reversed again, taking losses on both reverses.

However, keeping the risk in line with the above mentioned parameters allowed me to take the losers and add very quickly to the winner and overcome those losses and end up with a 1% win for the day. Oddly enough, the short case I laid out also worked well but I was long gone by that time. I had an early morning meeting and had to go.

A big thumbs up for the profit, a big thumbs down for the execution. Sometimes it works out like that. The goal is to minimize the size of the inevitable mistakes and maximize the size of the winners when you get it right. I may have gotten the selection process all screwed up as well. Maybe I should have been waiting on the short that happened after I was done. Small risk there with bigger reward....who knows. I made money following a step by step process and that is what counts.

Friday, July 28, 2017

Weekly Update

No trades yesterday as I went to Phoenix early in the day to get steroid injections in my back at specialist there. They hurt like hell for about 2 seconds and then they are magic shots. Good for about 4-6 months. Anyway, 10 total hours over and back.

Today two trades on NQ both longs. Both stopped to the tick before the reversal to my intended target zones. Then out the door to attend to a couple of family items and now back to the machine to grind out the lost hours from yesterday on the day job.

My daughters 15th birthday is tomorrow so lots going on there today and tomorrow so a busy weekend ahead. She starts school Thursday next week and we still have a couple of things to do to get ready for that so will have a few hours next week devoted to her and her school.

On a side note, I did 8 of the 10 hours yesterday in silence just thinking, zoning out and otherwise enjoying a very prolonged time away from the deluge of noise that invades our every waking minute. What an incredible thing it was. It's been a long time since I did anything like that and I might do it again in a month or so.

One of the side benefits of quiet time is your subconscious has time to work with out more input and the last two hours a business idea popped into my head and I thought about that from 4:30 when I was on the road until midnight when I finally was able to clear my mind from the idea long enough to fall asleep. Its unrelated to trading which is good and its about something I have had a life long passion about. More later if and when I decide to get it off the ground which won't be until after this project is over. It will require a number of hours thinking and planning through some fairly detail items but once done will involve a physical product as well as intellectual property. Who knows where things like this lead.

Cheers every one, have a great weekend.

Today two trades on NQ both longs. Both stopped to the tick before the reversal to my intended target zones. Then out the door to attend to a couple of family items and now back to the machine to grind out the lost hours from yesterday on the day job.

My daughters 15th birthday is tomorrow so lots going on there today and tomorrow so a busy weekend ahead. She starts school Thursday next week and we still have a couple of things to do to get ready for that so will have a few hours next week devoted to her and her school.

On a side note, I did 8 of the 10 hours yesterday in silence just thinking, zoning out and otherwise enjoying a very prolonged time away from the deluge of noise that invades our every waking minute. What an incredible thing it was. It's been a long time since I did anything like that and I might do it again in a month or so.

One of the side benefits of quiet time is your subconscious has time to work with out more input and the last two hours a business idea popped into my head and I thought about that from 4:30 when I was on the road until midnight when I finally was able to clear my mind from the idea long enough to fall asleep. Its unrelated to trading which is good and its about something I have had a life long passion about. More later if and when I decide to get it off the ground which won't be until after this project is over. It will require a number of hours thinking and planning through some fairly detail items but once done will involve a physical product as well as intellectual property. Who knows where things like this lead.

Cheers every one, have a great weekend.

Wednesday, July 26, 2017

CL & NQ

I have about an hour between now and when I have to be back at it. Thought I'd post a short update.

I'm making money, slower than I want but it is steady. Funny thing is, I am trading both CL and NQ. I ran the numbers today. The profit is coming from CL. NQ has been choppy during the cash hours but smooth and mostly pretty tradeable during the European session. I might have to reduce my exposure to NQ.

Today was another loser on NQ with a large winner on CL just after inventory. A long at around 42.45. Took it off as the selling came in near the top. A very pleasing trade today. I had a shot at getting in on the slow grind up after the spike down but I elected to not take it. The pace was slow and I wasn't in the mood.

Ok, time to relax for 45 minutes before hitting the grind again.

Cheers.

I'm making money, slower than I want but it is steady. Funny thing is, I am trading both CL and NQ. I ran the numbers today. The profit is coming from CL. NQ has been choppy during the cash hours but smooth and mostly pretty tradeable during the European session. I might have to reduce my exposure to NQ.

Today was another loser on NQ with a large winner on CL just after inventory. A long at around 42.45. Took it off as the selling came in near the top. A very pleasing trade today. I had a shot at getting in on the slow grind up after the spike down but I elected to not take it. The pace was slow and I wasn't in the mood.

Ok, time to relax for 45 minutes before hitting the grind again.

Cheers.

Friday, July 21, 2017

Quick update

It's been a week since my last post. I haven't really had time for posting and I don't today but I'm squeezing one in just because I want to and have about 5 minutes.

A few weeks go I had my best week ever. Then I had nothing but back and forth and then some draw down. Lots of frustration for me in this time period. I've been working 10-12 hours a day making decent money but honestly less than if I just followed my trading plan and rules like a boss. Still I'm grateful for it.

Late last week and this week, I've recovered most of the drawdown and very near new equity highs again. It's been a slow slog through and while I'm glad for the recovery, I wish it were faster. That said, I am approaching or at least it feels as though I am, a place of detachment concerning the outcome of each trade knowing that if I just do it long enough, the law of large numbers will work in my favor. I'm also trading less than before, 1-3 trades a day for the most part and I like that even better.

This project I'm working on appears to have some legs and so I'm going to milk it for as long and as much as I can. Who knows what the future holds.

Cheers.

A few weeks go I had my best week ever. Then I had nothing but back and forth and then some draw down. Lots of frustration for me in this time period. I've been working 10-12 hours a day making decent money but honestly less than if I just followed my trading plan and rules like a boss. Still I'm grateful for it.

Late last week and this week, I've recovered most of the drawdown and very near new equity highs again. It's been a slow slog through and while I'm glad for the recovery, I wish it were faster. That said, I am approaching or at least it feels as though I am, a place of detachment concerning the outcome of each trade knowing that if I just do it long enough, the law of large numbers will work in my favor. I'm also trading less than before, 1-3 trades a day for the most part and I like that even better.

This project I'm working on appears to have some legs and so I'm going to milk it for as long and as much as I can. Who knows what the future holds.

Cheers.

Friday, July 14, 2017

Profitable but....

Tough day for trading....I managed a decent day overall but not because I was good....I think I got lucky mostly...Still I will take it.

No time for in depth discussion today....charts tell the story...two 100+ tick trades today on NQ possible...I got 80 out of 200 possible....oh well...

No time for in depth discussion today....charts tell the story...two 100+ tick trades today on NQ possible...I got 80 out of 200 possible....oh well...

Wednesday, July 12, 2017

Sheesh X 2

I sat down at the computer just as both CL and NQ broke and ran up. No pull backs to get in on....had to let them both go. My heart was sick.

On CL, got long just after inventory. -1%. The subsequent collapse offered no reasonable place with acceptable risk to short even thought I knew it was going straight down. Again, had to let it go. Done with CL.

On NQ, kept seeing weakness at the premarket highs after the initial run up. The opening range high held and held. So I eventually sold it very near the ORH expecting a nice collapse similar to CL as we are near the top of the trend channel.Nope. Full stop out. -.50%. Shorted one more time, same result. -5%. full 1% loss today on NQ. Instead, it just started grinding up, essentially a full trend day with lots of sideways movement in between algo bursts higher. Wasn't around for the middle part of that but its just grinding away at the top of the daily trend channel.

All in all, a complete bust today.

No pics today....

On CL, got long just after inventory. -1%. The subsequent collapse offered no reasonable place with acceptable risk to short even thought I knew it was going straight down. Again, had to let it go. Done with CL.

On NQ, kept seeing weakness at the premarket highs after the initial run up. The opening range high held and held. So I eventually sold it very near the ORH expecting a nice collapse similar to CL as we are near the top of the trend channel.Nope. Full stop out. -.50%. Shorted one more time, same result. -5%. full 1% loss today on NQ. Instead, it just started grinding up, essentially a full trend day with lots of sideways movement in between algo bursts higher. Wasn't around for the middle part of that but its just grinding away at the top of the daily trend channel.

All in all, a complete bust today.

No pics today....

Tuesday, July 11, 2017

Sheesh....

Video says it all....

On a different note, I've started intermittent fasting along with some MCTs, ACV and a some other things to get some of the weight off. It's been two days, already lost 6.5 pounds. Its not painful (yet) and there is a ton of science to support the idea. I've never been able to fast due to low blood sugar issues but this works for me. Eat my last meal between 4:30-5:30 in the afternoon and eat my first meal around 9:30-10:30 in the morning. When I get up, some bullet proof coffee which I didn't think I would like but its very yummy, an ACV concoction 30 minutes before my first meal and presto, I'm fasting about 16 hours a day with no ill side effects. Its almost magic.

I know there is a lot more to learn and implement but for now its baby steps. I want to develop this habit and routine before adding the more complicated stuff.

Cheers.

On a different note, I've started intermittent fasting along with some MCTs, ACV and a some other things to get some of the weight off. It's been two days, already lost 6.5 pounds. Its not painful (yet) and there is a ton of science to support the idea. I've never been able to fast due to low blood sugar issues but this works for me. Eat my last meal between 4:30-5:30 in the afternoon and eat my first meal around 9:30-10:30 in the morning. When I get up, some bullet proof coffee which I didn't think I would like but its very yummy, an ACV concoction 30 minutes before my first meal and presto, I'm fasting about 16 hours a day with no ill side effects. Its almost magic.

I know there is a lot more to learn and implement but for now its baby steps. I want to develop this habit and routine before adding the more complicated stuff.

Cheers.

Monday, July 10, 2017

Buy and Hold

Well I made money today...and I made a decent amount...1% I think...which is fine...BUT I totally screwed up the read and the execution. I should have just bought and held!

On NQ, I was short early and it was a nice trade, Had I held it to the LOD, I think I might have been done at that point. But I exited at Friday's POC which was a nice trade. However, I was really expecting it to go to Friday's HOD and then bounce which it did but not until after some crazy swings at the open. I actually bought Friday's HOD and POC level but I took it off at 20 ticks because I didn't believe it would launch up like it did. Afterall, price action was directly into over head resistance. I was unprepared for that. However, once it started showing strength, I bought it twice more, each time for only 20 ticks, again because I was unconvinced of the true strength of the upward move. To be fair, I still not really convinced it was real even at this late junction. So I made 80 ticks on NQ when there was 228 ticks to be had.

On CL, I bought and then closed it immediately, then bought it again on the test of the lows where it held a perfect fib 78.6pull back level. I bought it at the inside break level and of course closed it right away. I thought it was going down. Afterall, it had rejected at the Friday VAL low level which is what it was supposed to do in a down trend. So I resold it again at the VAL and again at Friday's POC, both losers. Then I wanted to buy it at the ORH which it often retests after breaking out, no fill and I then just walked away from CL after that.

So 80 ticks on NQ and - 20 ticks on CL for a net 20 ticks. Yes profitable today but seems like such a waste.

I think I overthought it. Instead of just going with the flow, I made assumptions about the firmness of VP levels when in fact, they are just that, levels subject to breakage. Price action and order flow at the levels are the key. I'm not proficient at that yet apparently.

Still I'm on a three day win streak. Haven't had that in a while.

Cheers.

On NQ, I was short early and it was a nice trade, Had I held it to the LOD, I think I might have been done at that point. But I exited at Friday's POC which was a nice trade. However, I was really expecting it to go to Friday's HOD and then bounce which it did but not until after some crazy swings at the open. I actually bought Friday's HOD and POC level but I took it off at 20 ticks because I didn't believe it would launch up like it did. Afterall, price action was directly into over head resistance. I was unprepared for that. However, once it started showing strength, I bought it twice more, each time for only 20 ticks, again because I was unconvinced of the true strength of the upward move. To be fair, I still not really convinced it was real even at this late junction. So I made 80 ticks on NQ when there was 228 ticks to be had.

On CL, I bought and then closed it immediately, then bought it again on the test of the lows where it held a perfect fib 78.6pull back level. I bought it at the inside break level and of course closed it right away. I thought it was going down. Afterall, it had rejected at the Friday VAL low level which is what it was supposed to do in a down trend. So I resold it again at the VAL and again at Friday's POC, both losers. Then I wanted to buy it at the ORH which it often retests after breaking out, no fill and I then just walked away from CL after that.

So 80 ticks on NQ and - 20 ticks on CL for a net 20 ticks. Yes profitable today but seems like such a waste.

I think I overthought it. Instead of just going with the flow, I made assumptions about the firmness of VP levels when in fact, they are just that, levels subject to breakage. Price action and order flow at the levels are the key. I'm not proficient at that yet apparently.

Still I'm on a three day win streak. Haven't had that in a while.

Cheers.

Friday, July 7, 2017

One and probably done

Missed the break out because I wasn't convinced it was a break out right then. But I sold the LVN from yesterday and made 40 ticks on the fade.

Today I will be headed to California to my last Grandmother's viewing. Tomorrow is the funeral. We weren't close but in the last few years, we had gotten somewhat closer and she loved my daughter like crazy. She was 96 and told my brother a few weeks ago she had no intention of living this long! She was in her right mind right up until the day she passed. We went to see her a couple of weeks ago and as it turns out, she passed the next day. So nice to have that last opportunity to be with her.

Cheers.

EDIT:

Finally got this short set up. Took it and waited quite a while...but I got the 20 ticks I was looking for.

Today I will be headed to California to my last Grandmother's viewing. Tomorrow is the funeral. We weren't close but in the last few years, we had gotten somewhat closer and she loved my daughter like crazy. She was 96 and told my brother a few weeks ago she had no intention of living this long! She was in her right mind right up until the day she passed. We went to see her a couple of weeks ago and as it turns out, she passed the next day. So nice to have that last opportunity to be with her.

Cheers.

EDIT:

Finally got this short set up. Took it and waited quite a while...but I got the 20 ticks I was looking for.

Thursday, July 6, 2017

Lunch money

Today is the first day back from a long weekend we spent in lovely San Diego. We went to Sea World, Korea Town, Little Italy, and the main event, a harbor cruise for the 4th of July fireworks show the City of San Diego puts on every year. It really is special and seeing it from the harbor on board one of the ships is quite nice.

I didn't even look at the charts while I was gone. A good break now and then is essential to good mental health and consequently, good trading.

I made a short video about my trades today and after a couple CL losses and a small loss on NQ, my winner made enough for a decent lunch for 3 in a great restaurant in San Diego. As an aside, don't go to the movies in Liberty Station. Pricey isn't the word for it. Robbery is more like it!!

Anyway, on to the video.

I didn't even look at the charts while I was gone. A good break now and then is essential to good mental health and consequently, good trading.

I made a short video about my trades today and after a couple CL losses and a small loss on NQ, my winner made enough for a decent lunch for 3 in a great restaurant in San Diego. As an aside, don't go to the movies in Liberty Station. Pricey isn't the word for it. Robbery is more like it!!

Anyway, on to the video.

Thursday, June 29, 2017

Bye Bye Bye CL????

My love affair, if you can call it that with CL is slowly but far more rapidly most recently , fading away. The beautiful moves it used to make every morning are slowly becoming a thing of history. In its place at least for the moment (am I becoming a player?) is NQ, It moves more or less like CL of old, has a smaller tick value which leads to better risk control and once in a while, a lot more size potential!

Today I made my first official NQ trade. Yes I had a couple earlier in the week just to test the waters but today I made it my priority instead of CL. Of course, I got stop ran with a subsequent nose dive to the target! But instead of cussing it out like I have been in the past, I just laughed and let it go. I did try to get a fill at resistance but it missed printing me by one tick before hitting the target zone.

This trade was a potential 110 tick trade per contract and I would have been at max size had I not been stopped out. I went in small with the intention of sizing up rapidly if it went in my favor but it one ticked me in and reversed to the stop and then reversed to target. Nice....

All that said, that trade felt better than most of the CL trades I've taken in the last few months. I like the way the tape moves, I like the trendiness of it, etc. So I think I will work with NQ as my primary instrument at least until it begins acting different. I think I held on to the idea of CL way to long. I might even look at some of the other not so obvious instruments to see how they move. After all, I'm not supposed to marry the thing, just trade it and I've been married to CL for to long now. I mean, NQ has moved 150 ticks and CL has barely ground out 20 or so in the last hour....please....

Cheers.

Oh, here's a chart and a video

Today I made my first official NQ trade. Yes I had a couple earlier in the week just to test the waters but today I made it my priority instead of CL. Of course, I got stop ran with a subsequent nose dive to the target! But instead of cussing it out like I have been in the past, I just laughed and let it go. I did try to get a fill at resistance but it missed printing me by one tick before hitting the target zone.

This trade was a potential 110 tick trade per contract and I would have been at max size had I not been stopped out. I went in small with the intention of sizing up rapidly if it went in my favor but it one ticked me in and reversed to the stop and then reversed to target. Nice....

All that said, that trade felt better than most of the CL trades I've taken in the last few months. I like the way the tape moves, I like the trendiness of it, etc. So I think I will work with NQ as my primary instrument at least until it begins acting different. I think I held on to the idea of CL way to long. I might even look at some of the other not so obvious instruments to see how they move. After all, I'm not supposed to marry the thing, just trade it and I've been married to CL for to long now. I mean, NQ has moved 150 ticks and CL has barely ground out 20 or so in the last hour....please....

Cheers.

Oh, here's a chart and a video

Wednesday, June 28, 2017

Mid week update...actually

Taking 5 minutes out to recap the last three days.

Trading well....5M charts and a tick chart on inventory days POST inventory number...

Being very deliberate I have booked 70 ticks per contract this week in both the CL and the NQ. There has been LOTS more money available. But within the context of my trading hours and limitations, I am quite pleased.

I used the tick chart today to get into CL on the long side just a bit early, waited it out, got long again and rode it for 40 ticks I think. No trades in NQ today even though there was opportunity, the cost for that opportunity was well beyond my comfort zone so no trades.

Net net, its been a good week so far.

I am working on my mind every day. I feel different. Something is different. The energy has changed even if only slightly but I can feel it and I like it.

Ok, back to the day job.

Trading well....5M charts and a tick chart on inventory days POST inventory number...

Being very deliberate I have booked 70 ticks per contract this week in both the CL and the NQ. There has been LOTS more money available. But within the context of my trading hours and limitations, I am quite pleased.

I used the tick chart today to get into CL on the long side just a bit early, waited it out, got long again and rode it for 40 ticks I think. No trades in NQ today even though there was opportunity, the cost for that opportunity was well beyond my comfort zone so no trades.

Net net, its been a good week so far.

I am working on my mind every day. I feel different. Something is different. The energy has changed even if only slightly but I can feel it and I like it.

Ok, back to the day job.

Thursday, June 22, 2017

Mid week update

Ok, its not mid week but its as close as I'm gonna get this week.

This project is sucking up time like a black hole. It pays really well so I'm not complaining but in a perfect world, I wouldn't need it. But I do and so we work with what we have! They pay by the hour with essentially no limits on the number of hours you can work in a week with a minimum of 40....so I've been banking a lot of them since the beginning of the project....I can't sustain this indefinitely but this phase of the project will likely be over end of this month. Once that's done, there is probably going to be a much longer aspect of the project with more focus on quality vs quantity which means it could last or months.

I traded Monday, Tuesday and yesterday. I can't really remember what happened the first two days, they seem like they were a lifetime ago but yesterday I made a bunch of money prior to inventory and gave it back after inventory. I'll try to do a weekly update on Saturday or Sunday.

Scalping works well when you can pay really close attention and not so well when your attention is divided as it was yesterday.

Today, no trading as I had no time this morning, I put the charts up on a secondary monitor which I never use and glanced at them from time to time but with a never ending flow of files to review and pass judgement on, I decided not to trade today.

My daughter hyper extended her elbow last week which appears to be a season ending injury before its even started. Shes got at least two weeks of rest which is going to make the summer camp impossible. She's still going but can only participate in activities that doesn't include putting pressure on her left arm. Doctors note and everything. She is pretty bummed out about it. Its a good life lesson in how to handle disappointment both for her and for us.

We ditched the cable tv that cost about $150 a month and replaced it with SlingTV and our existing Netflix and Amazon Prime memberships. New monthly cost of entertainment, $52.00. I'd say that is a good thing. My kiddo NEVER watches TV, I only watch sports which I get on SlingTV, my wife only watches old movies and British TV and she gets those on SlingTV, NetFlix and YouTube and we can get all the music we want for free on YouTube or Pandora so no need to pay for all those extra channels on cable. Can't believe we didn't do this a long time ago. I watched the baseball game today on SlingTV sitting in my daughter's doctors office . That was awesome!!

I'm seriously considering getting a standing desk or perhaps one of those risers that sit on top of your desk and allow you to raise your monitor and keyboard up and down as you like. They cost anywhere from $200 for base model to around $500 for a higher end one. Has anyone had experience with these contraptions? If so, drop me a line and let me know how it has gone for you. I'm sick of sitting all day and I type better when I am standing anyway.

Last thing, I am also considering a flirtation with NQ. It moves similar to CL but doesn't seem to have as many stop runs. I've been watching it for a few days now albeit not that close due to trading CL and working at the same time but in time, I think CL may trade more like QM does now. As energy becomes more and more renewable based, oil is going to eventually find a price range of $25-40 a barrel and more than likely lose its liquidity. For instance, I could NOT get filled on a single lot the other day on a profit target. granted, my target was at the extreme of the range and it must have printed it at least 10-20 times without filling it. I punched out manually at that point but that's the worst experience with not getting a fill I've ever had in terms of watching it print my price a dozen or more times without a fill. So NQ looks attractive from a movement standpoint but I haven't traded it live in a really long time so not sure about fills and liquidity yet. If anyone has suggestions or ideas along these lines, let me know.

Ok, its getting late in the afternoon, I've been up since 3:30AM I think, I can't really remember and I have commitments tonight until about 9PM or so....long day and I'm already tired enough to sleep.

Cheers.

This project is sucking up time like a black hole. It pays really well so I'm not complaining but in a perfect world, I wouldn't need it. But I do and so we work with what we have! They pay by the hour with essentially no limits on the number of hours you can work in a week with a minimum of 40....so I've been banking a lot of them since the beginning of the project....I can't sustain this indefinitely but this phase of the project will likely be over end of this month. Once that's done, there is probably going to be a much longer aspect of the project with more focus on quality vs quantity which means it could last or months.

I traded Monday, Tuesday and yesterday. I can't really remember what happened the first two days, they seem like they were a lifetime ago but yesterday I made a bunch of money prior to inventory and gave it back after inventory. I'll try to do a weekly update on Saturday or Sunday.

Scalping works well when you can pay really close attention and not so well when your attention is divided as it was yesterday.

Today, no trading as I had no time this morning, I put the charts up on a secondary monitor which I never use and glanced at them from time to time but with a never ending flow of files to review and pass judgement on, I decided not to trade today.

My daughter hyper extended her elbow last week which appears to be a season ending injury before its even started. Shes got at least two weeks of rest which is going to make the summer camp impossible. She's still going but can only participate in activities that doesn't include putting pressure on her left arm. Doctors note and everything. She is pretty bummed out about it. Its a good life lesson in how to handle disappointment both for her and for us.

We ditched the cable tv that cost about $150 a month and replaced it with SlingTV and our existing Netflix and Amazon Prime memberships. New monthly cost of entertainment, $52.00. I'd say that is a good thing. My kiddo NEVER watches TV, I only watch sports which I get on SlingTV, my wife only watches old movies and British TV and she gets those on SlingTV, NetFlix and YouTube and we can get all the music we want for free on YouTube or Pandora so no need to pay for all those extra channels on cable. Can't believe we didn't do this a long time ago. I watched the baseball game today on SlingTV sitting in my daughter's doctors office . That was awesome!!

I'm seriously considering getting a standing desk or perhaps one of those risers that sit on top of your desk and allow you to raise your monitor and keyboard up and down as you like. They cost anywhere from $200 for base model to around $500 for a higher end one. Has anyone had experience with these contraptions? If so, drop me a line and let me know how it has gone for you. I'm sick of sitting all day and I type better when I am standing anyway.

Last thing, I am also considering a flirtation with NQ. It moves similar to CL but doesn't seem to have as many stop runs. I've been watching it for a few days now albeit not that close due to trading CL and working at the same time but in time, I think CL may trade more like QM does now. As energy becomes more and more renewable based, oil is going to eventually find a price range of $25-40 a barrel and more than likely lose its liquidity. For instance, I could NOT get filled on a single lot the other day on a profit target. granted, my target was at the extreme of the range and it must have printed it at least 10-20 times without filling it. I punched out manually at that point but that's the worst experience with not getting a fill I've ever had in terms of watching it print my price a dozen or more times without a fill. So NQ looks attractive from a movement standpoint but I haven't traded it live in a really long time so not sure about fills and liquidity yet. If anyone has suggestions or ideas along these lines, let me know.

Ok, its getting late in the afternoon, I've been up since 3:30AM I think, I can't really remember and I have commitments tonight until about 9PM or so....long day and I'm already tired enough to sleep.

Cheers.

Friday, June 16, 2017

Charts

Two charts to show you.

The MP/VP chart...its messy but makes sense.....then the tick chart. I also have a daily minimized, a 120M, a 30M and a 5M stacked up on the right beside the tick chart. Those all have a single 89EMA on them.

The trading chart has an 89EMA, a 34 EMA and a multi EMA with 21 being the largest one of those....Charts were out of sync today against the HTF but the 5M was in agreement with the tick chart and yesterday's VPOC and 50% level lined up and looked likely to be target areas. I went there twice with shorts....plus a bounce off the current day mid point and the current day Volume VAL. That trade worked as well.

Yesterday and Wednesday looked pretty similar in terms of how the trades were entered and exited. Nothing fancy, just getting in on the current dominate trend and taking bites where it appears most likely to work.

Interestingly enough, at least yesterday and today, Most of my trades were 2:1. I did not track it on Wednesday but I think it was more or less about the same. In that regard, I can win less than 50% of the time and still make money. Since I primarily like to risk $100 or less per contract per trade, when presented with risk of 5 ticks or less, I can trade larger size. This happened once today which was nice. So I risked $100 to make $200 once and $60 to make $100 twice. So that worked out to risking $220 to make $500. Just a bit better than a 2RR day!

If I am at the charts when all the time frames align, I might be able to to find 3 or 4:1 trades without having to wait as long for them to pay of as these did today. With a 5 tick risk (not going to see these all the time) and a 20 tick trade, I'm looking at 4:1 and that works for me. I can live with that.

I don't know if I am going to include charts all the time when I post but I've included them here for reference.

It's getting late and I'm feeling the effects of working almost around the clock this week. Tomorrow is sleep in day (til 7AM that is) some honey do's around the house, 3-4 hours of work and then perhaps a movie later in the day. On a side note, its supposed to 111 degrees tomorrow and 119 by Tuesday next week . That's 43.8 and 48.3 for those of you using Celsius! People say its not actually hell but you can see it from here!

Have a great weekend!

The MP/VP chart...its messy but makes sense.....then the tick chart. I also have a daily minimized, a 120M, a 30M and a 5M stacked up on the right beside the tick chart. Those all have a single 89EMA on them.

The trading chart has an 89EMA, a 34 EMA and a multi EMA with 21 being the largest one of those....Charts were out of sync today against the HTF but the 5M was in agreement with the tick chart and yesterday's VPOC and 50% level lined up and looked likely to be target areas. I went there twice with shorts....plus a bounce off the current day mid point and the current day Volume VAL. That trade worked as well.

Yesterday and Wednesday looked pretty similar in terms of how the trades were entered and exited. Nothing fancy, just getting in on the current dominate trend and taking bites where it appears most likely to work.

Interestingly enough, at least yesterday and today, Most of my trades were 2:1. I did not track it on Wednesday but I think it was more or less about the same. In that regard, I can win less than 50% of the time and still make money. Since I primarily like to risk $100 or less per contract per trade, when presented with risk of 5 ticks or less, I can trade larger size. This happened once today which was nice. So I risked $100 to make $200 once and $60 to make $100 twice. So that worked out to risking $220 to make $500. Just a bit better than a 2RR day!

If I am at the charts when all the time frames align, I might be able to to find 3 or 4:1 trades without having to wait as long for them to pay of as these did today. With a 5 tick risk (not going to see these all the time) and a 20 tick trade, I'm looking at 4:1 and that works for me. I can live with that.

I don't know if I am going to include charts all the time when I post but I've included them here for reference.

It's getting late and I'm feeling the effects of working almost around the clock this week. Tomorrow is sleep in day (til 7AM that is) some honey do's around the house, 3-4 hours of work and then perhaps a movie later in the day. On a side note, its supposed to 111 degrees tomorrow and 119 by Tuesday next week . That's 43.8 and 48.3 for those of you using Celsius! People say its not actually hell but you can see it from here!

Have a great weekend!

Do what works

Patience is the key....or at least its in the top three things you need to be successful as a trader.

The other two might the edge you have and sound money management.

Beyond these three things, there is only one command in trading.

Do what works.

That's it. Well maybe there's one more thing....Do what works FOR YOU. Ok, that's it.

Ed Sekoyta said a trader should only trade as system that works with their personality. This is, in part, a portion of what it means to get yer mind right. Stop trying to work something that doesn't work for you. Insanity right? Indeed.

As part of the deconstruction of my process and mental/emotional state, I've been reviewing past journals. Some really old one as well as some more recent ones. A couple of years ago, I went several months without a losing month. A few weeks ago I had my largest winning week ever. In January I didn't have losing day, a first for me. And there have been numerous other "winning streaks" along the way. They all have two things in common.

1. In each instance, I was scalping 10-20 ticks per trade depending on the daily ranges.

2. In each instance, I began looking for ways to further maximize the SIZE of the winning trades, whatever they were at the time.

Essentially I got greedy looking for more. More for me requires a set of traits and skills I do not have. I have the knowledge to trade for larger wins but the emotional traits are not in my possession. Every time I begin winning, I also knew I was leaving money on the table IF ONLY I would hold longer or wait longer for better set ups, etc....

Trouble is, when I do the IF ONLYs, I don't actually do them. I say I am but I behave as though I am scalping. The net result is lots of break evens, losers and very few large winners needed to make this way of trading work. Some overcome this by scaling out of a trade but this ignores the mathematical fact that losing with an initial large position does not overcome taking smaller profits on most of the position that is a winner unless you let the last bit run a really long time. Most don't. I didn't and so this doesn't work at least for me.

The final analysis is this; I am a scalper. I suppose I've always known it. But over time, I've allowed well meaning people to talk me out of it. People like;

Big Mike

Tiger Trader

Others like these

Assorted "experts" I've read over the years.

Well Meaning Friends that have written me private messages over the years.

Anonymous blog readers that send me private messages.

All telling me I must have bigger wins. That scalping is a losers game. And yet, I am personally acquainted with a couple of very wealthy scalpers. Every time I do this exercise, I find people killing it by scalping. There is a disconnect here. Perhaps the non scalpers are telling me the truth....at least from their perspective and the scalpers are also telling me the truth......from their perspective.

I have a theory about the universe. That when truth presents itself, something inside a person will resonate with that truth. Whatever the truth that person needs to hear for themselves will leap within their spirit. And somehow scalping has resonated with me. Its time I acknowledged this publicly.

There is a book out now that is quite popular. The author even has a Ted Talk. The book is called "The Magic of not giving a f**k!. I haven't read the book nor listened to the Ted Talk. The title looks like click bait to me but there is a truth contained within the click bait. That is, those that are successful in any endeavor have really one thing in common. They don't care what other people think about them in their pursuit of their goals.

I have spent a long time as a trader giving a f**k about what other traders thought about me. I knew I needed to have big wins to impress people and truth is, this is a limiting belief.

As John D. Spooner once said, "Do you want to make money or do you want to fool around?"

I've been fooling around it appears trying to impress everyone except my bank account.

On Wednesday, I went back to scalping. I made 50 ticks, yesterday, I made 30 ticks, today I made 30 ticks. No trade was larger than 10 ticks. Granted I could have sold on Wednesday and just held and made a ton of money but that goes right back to the issue I discussed earlier. Greed.

I made more in the last three days than I did in the 30 days prior. I will be a scalper from now on.

It fits my personality like a glove. There is a source of pride and ego in being able to say I made a 6R trade or made a 100 tick trade but I would rather make $100-$200 per contract day in and day out than try to hit home runs every day.

Onward and upward as they say.

Suggested by Anonymous.

The other two might the edge you have and sound money management.

Beyond these three things, there is only one command in trading.

Do what works.

That's it. Well maybe there's one more thing....Do what works FOR YOU. Ok, that's it.

Ed Sekoyta said a trader should only trade as system that works with their personality. This is, in part, a portion of what it means to get yer mind right. Stop trying to work something that doesn't work for you. Insanity right? Indeed.

As part of the deconstruction of my process and mental/emotional state, I've been reviewing past journals. Some really old one as well as some more recent ones. A couple of years ago, I went several months without a losing month. A few weeks ago I had my largest winning week ever. In January I didn't have losing day, a first for me. And there have been numerous other "winning streaks" along the way. They all have two things in common.

1. In each instance, I was scalping 10-20 ticks per trade depending on the daily ranges.

2. In each instance, I began looking for ways to further maximize the SIZE of the winning trades, whatever they were at the time.

Essentially I got greedy looking for more. More for me requires a set of traits and skills I do not have. I have the knowledge to trade for larger wins but the emotional traits are not in my possession. Every time I begin winning, I also knew I was leaving money on the table IF ONLY I would hold longer or wait longer for better set ups, etc....

Trouble is, when I do the IF ONLYs, I don't actually do them. I say I am but I behave as though I am scalping. The net result is lots of break evens, losers and very few large winners needed to make this way of trading work. Some overcome this by scaling out of a trade but this ignores the mathematical fact that losing with an initial large position does not overcome taking smaller profits on most of the position that is a winner unless you let the last bit run a really long time. Most don't. I didn't and so this doesn't work at least for me.

The final analysis is this; I am a scalper. I suppose I've always known it. But over time, I've allowed well meaning people to talk me out of it. People like;

Big Mike

Tiger Trader

Others like these

Assorted "experts" I've read over the years.

Well Meaning Friends that have written me private messages over the years.

Anonymous blog readers that send me private messages.

All telling me I must have bigger wins. That scalping is a losers game. And yet, I am personally acquainted with a couple of very wealthy scalpers. Every time I do this exercise, I find people killing it by scalping. There is a disconnect here. Perhaps the non scalpers are telling me the truth....at least from their perspective and the scalpers are also telling me the truth......from their perspective.

I have a theory about the universe. That when truth presents itself, something inside a person will resonate with that truth. Whatever the truth that person needs to hear for themselves will leap within their spirit. And somehow scalping has resonated with me. Its time I acknowledged this publicly.

There is a book out now that is quite popular. The author even has a Ted Talk. The book is called "The Magic of not giving a f**k!. I haven't read the book nor listened to the Ted Talk. The title looks like click bait to me but there is a truth contained within the click bait. That is, those that are successful in any endeavor have really one thing in common. They don't care what other people think about them in their pursuit of their goals.

I have spent a long time as a trader giving a f**k about what other traders thought about me. I knew I needed to have big wins to impress people and truth is, this is a limiting belief.

As John D. Spooner once said, "Do you want to make money or do you want to fool around?"

I've been fooling around it appears trying to impress everyone except my bank account.

On Wednesday, I went back to scalping. I made 50 ticks, yesterday, I made 30 ticks, today I made 30 ticks. No trade was larger than 10 ticks. Granted I could have sold on Wednesday and just held and made a ton of money but that goes right back to the issue I discussed earlier. Greed.

I made more in the last three days than I did in the 30 days prior. I will be a scalper from now on.

It fits my personality like a glove. There is a source of pride and ego in being able to say I made a 6R trade or made a 100 tick trade but I would rather make $100-$200 per contract day in and day out than try to hit home runs every day.

Onward and upward as they say.

Suggested by Anonymous.

Thursday, June 15, 2017

Tuesday, June 13, 2017

Scratch day

A directional move to the short side followed by a V bottom to new HOD....followed by sideways chop. Essentially a non-tradeable day. There was one short I could have taken that would have worked out well but I was otherwise occupied with this project....After the V turn at the bottom, I shorted near the highs for a smallish win followed by another short for a smallish loss. Overall a scratch for today.

A few days ago, I broke down and bought Fin-alg's VP and TPO indicator for ninja trader. Its not as robust as Sierra Chart's but its close enough for my purposes. Haven't traded with it yet, but its handy to have for sure. Working with those levels gives you something to lean on to set up your trades. Price action needs to confirm these levels of course but its nice to have.

No trading yesterday as I had a doctor appointment in Phoenix which takes all day since I have to drive 3 hours over and 3 hours back plus at least an hour at the doc's office plus whatever else we want to do. Turns into a 10-12 hour day most of the time.

Cheers...

A few days ago, I broke down and bought Fin-alg's VP and TPO indicator for ninja trader. Its not as robust as Sierra Chart's but its close enough for my purposes. Haven't traded with it yet, but its handy to have for sure. Working with those levels gives you something to lean on to set up your trades. Price action needs to confirm these levels of course but its nice to have.

No trading yesterday as I had a doctor appointment in Phoenix which takes all day since I have to drive 3 hours over and 3 hours back plus at least an hour at the doc's office plus whatever else we want to do. Turns into a 10-12 hour day most of the time.

Cheers...

Saturday, June 10, 2017

Weekly Update